Contents

- Base Parameters

- Other definitions

- Functions of interest

- Section 5.1.1 - Basic Keen model

- Section 5.1.2 - Keen Model with inflation

- Section 5.1.3 - Keen Model with Inflation and Speculation

- Section 5.2.1 - Keen Model with Inflation (Dynamics)

- Section 5.2.2 - Keen Model with Inflation and Speculation (Dynamics)

function out = inflation_paper()

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% % This code simulates the Keen model with inflation as % specified in Grasselli and Nguyen Huu (2015) % % authors: M. Grasselli and A. Nguyen Huu %%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%% close all clc warning off

Base Parameters

Equations (76),(77)

phi0 = 0.0401; %Phillips curve parameter phi1 = 6.41e-05; %Phillips curve parameter kappa0 = -0.0065; % constant parameter in investment function kappa1 = -5; % affine parameter in exponent of investment function kappa2 = 20; % coefficient in the exponent of investment function psi0 = 0.25; % parameter for speculation function psi1 = 0.02; % parameter for speculation function psi2 = 1.2; % parameter for speculation function

Other definitions

TOL = 1E-7; options = odeset('RelTol', TOL); txt_format = '%3.3g';

Functions of interest

inflation = @(x) eta_p*(markup*x-1); % inflation, equation (2.64) phillips = @(x) phi1./(1-x).^2- phi0; % Phillips curve, equation (76) phillips_prime = @(x) 2*phi1./(1-x).^3; % derivative of phillips curve phillips_inv = @(x) 1 - (phi1./(x+phi0)).^(1/2); % inverse of phillips curve investment= @(x) kappa0+exp(kappa1+kappa2.*x); % investment function, equation (25) investment_prime= @(x) kappa2.*exp(kappa1+kappa2.*x); % derivative of investment function investment_inv= @(x) (log(x-kappa0)-kappa1)./kappa2; % inverse of investment function speculation=@(x) psi0.*(exp(psi2.*(x-psi1))-1); % speculation function, equation (83)

Section 5.1.1 - Basic Keen model

% Equation (75) alpha = 0.025; % productivity growth rate beta = 0.02; % population growth rate delta = 0.01; % depreciation rate nu = 3; % capital to output ratio r = 0.03; % interest rate on loans pi_eq=investment_inv(nu*(alpha+beta+delta)) % profit share at interior equilibrium, equations (16) and (78) b_eq=(investment(pi_eq)-pi_eq)/(alpha+beta); % debt level at equilibrium, equation (19) lambda_eq=phillips_inv(alpha); % employment at equilibirum, equation (18) omega_eq=1-pi_eq-r*b_eq; % wage share at equilibrium, equation (17) eq1 =[omega_eq,lambda_eq,b_eq]

pi_eq =

0.1618

eq1 =

0.8361 0.9686 0.0702

Section 5.1.2 - Keen Model with inflation

% Equation (75) alpha = 0.025; % productivity growth rate beta = 0.02; % population growth rate delta = 0.01; % depreciation rate nu = 3; % capital to output ratio r = 0.03; % interest rate on loans % Additional parameters, equation (79) eta_p = 4; % adjustment speed for prices markup = 1.2; % mark-up value gamma = 0.8; % inflation sensitivity in the bargaining equation % Coefficients for quadratic for omega, equations before (30) a0=markup*eta_p; a1=alpha+beta-eta_p*(1+markup*(1-pi_eq)); a2=(eta_p-alpha-beta)*(1-pi_eq)+r*(investment(pi_eq)-pi_eq); a=[a0,a1,a2]; % Solve quadratic equation for omega omega_eq = roots(a); % Find interior equilibrium employment and debt, equations (28) and (29) inflation = @(x) eta_p*(markup*x-1); lambda_eq = phillips_inv(alpha+(1-gamma)*inflation(omega_eq)); b_eq=(investment(pi_eq)-pi_eq)./(alpha+beta+inflation(omega_eq)); % Display result, equation (81) eq1_plus=[omega_eq(1),lambda_eq(1),b_eq(1)] eq1_minus=[omega_eq(2),lambda_eq(2),b_eq(2)] inflation_eq = inflation(omega_eq) % % Compute omega3 using (33) % Something is wrong here: there is no solution for b3 % omega3=1/markup+(phillips(0)-alpha)/(markup*eta_p*(1-gamma)) % i3=inflation(omega3) % % % Compute b3 using (34) % b=[]; % syms b % eqn1=b*(i3+investment(1-omega3-r*b)/nu-delta-r); % eqn2=investment(1-omega3-r*b)-1+omega3; % b3=vpasolve(eqn1==eqn2,b)

eq1_plus =

0.8366 0.9693 0.0521

eq1_minus =

0.8255 0.9666 0.4213

inflation_eq =

0.0157

-0.0375

Section 5.1.3 - Keen Model with Inflation and Speculation

eta_p = 4; % adjustment speed for prices markup = 1.2; % mark-up value gamma = 0.8; % inflation sensitivity in the bargaining equation inflation = @(x) eta_p*(markup*x-1); % Additional parameters, equation before (83) rL= 0.03; % interest rate on loans rf= 0.028; % interest rate on deposits % Coefficients for the nonlinear equation for X, equation (62) v1=eta_p*markup*(pi_eq-1)-alpha-beta+eta_p; v2=eta_p*markup*(rL*investment(pi_eq)-rf*pi_eq); v3=(rL-rf)*eta_p*markup; % Solve equation (62) z=[]; syms z x=vpasolve(z^3+v1*z^2+v2*z+v3*speculation(z)==0,z); X=double(x); i_eq=X-alpha-beta % Find equilibirum values, equations (58)-(61) f_eq=speculation(X)/X; c_eq=(rL*investment(pi_eq)-rf*pi_eq+(rL-rf)*f_eq)/X; lambda_eq=phillips_inv(alpha-(1-gamma)*i_eq); omega_eq=1-pi_eq-c_eq; % Display equilibrium values, equation (84) % NOTE: these are slightly different from the values % shown in the paper, probably because some parameter is wrong eq1=[omega_eq,lambda_eq,c_eq,f_eq] inflation_eq=inflation(omega_eq)

i_eq =

-0.0311

eq1 =

0.8269 0.9700 0.0113 -0.1306

inflation_eq =

-0.0311

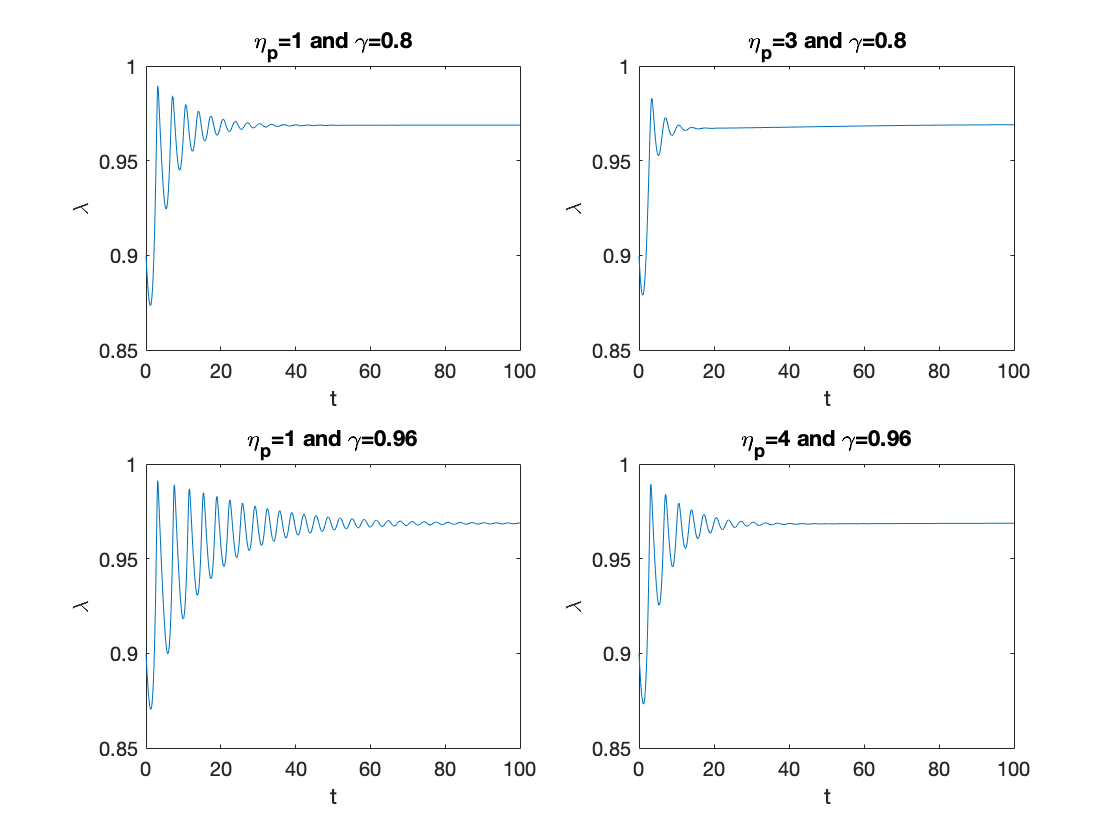

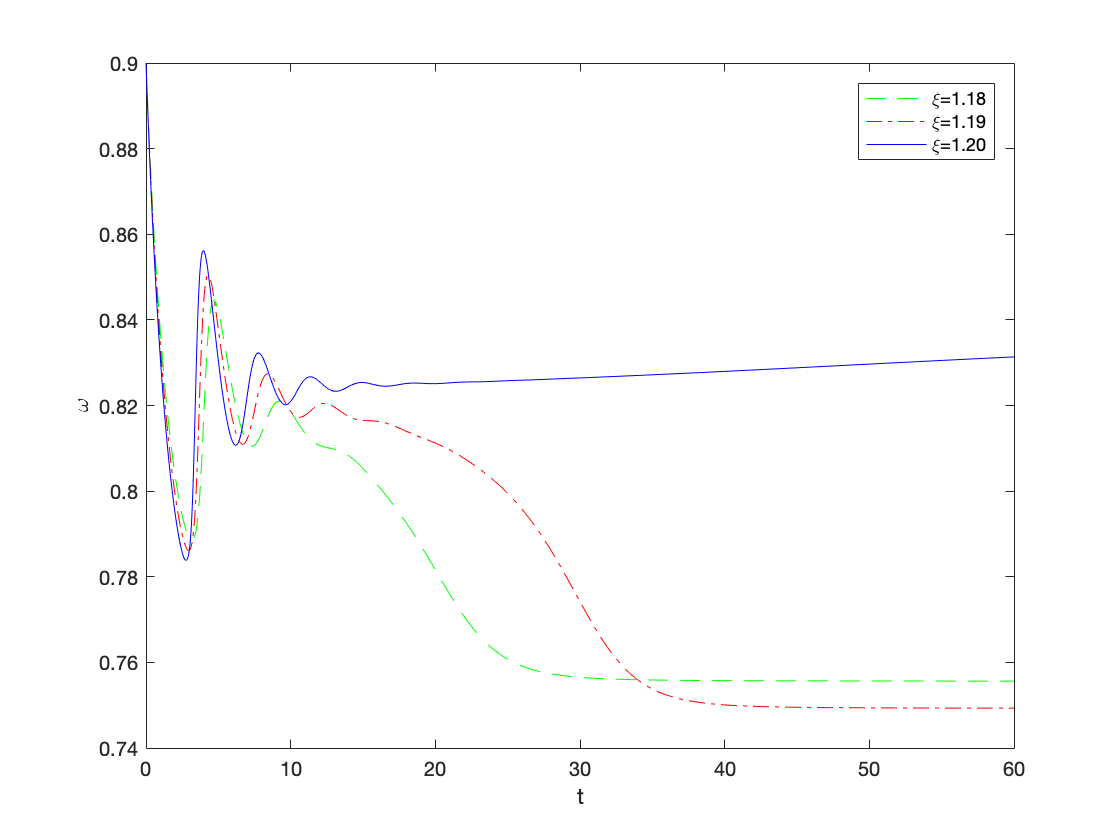

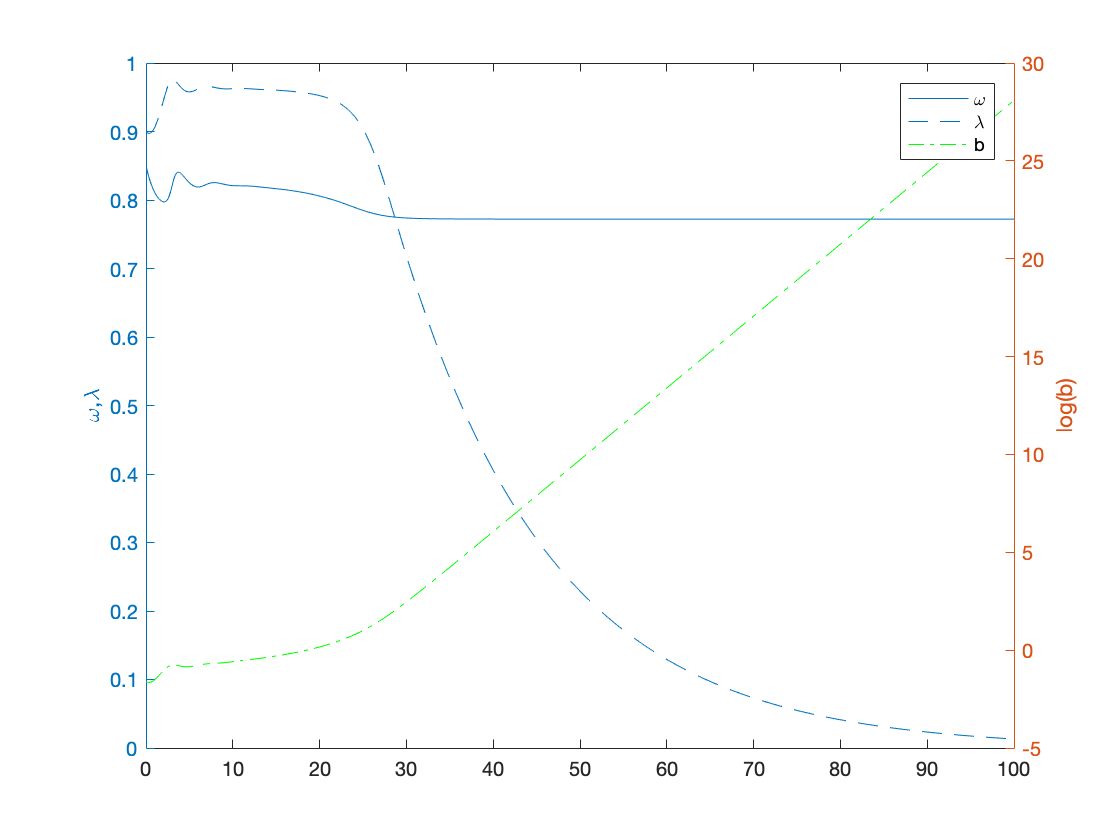

Section 5.2.1 - Keen Model with Inflation (Dynamics)

alpha = 0.025; % productivity growth rate beta = 0.02; % population growth rate delta = 0.01; % depreciation rate nu = 3; % capital to output ratio r = 0.03; % interest rate on loans % Figure 1 figure(1) omega0=0.9; lambda0=0.9; b0=0.3; T=100; subplot(2,2,1) eta_p=1; gamma=0.8; markup=1.20; inflation = @(x) eta_p*(markup*x-1); y0=[convert([omega0,lambda0]),b0]; [tK,yK] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); plot(tK,yK(:,2)) title('\eta_p=1 and \gamma=0.8') xlabel('t') ylabel('\lambda') subplot(2,2,2) eta_p=3; % NOTE: with eta_p=4 as in the paper, lambda collapses to zero! gamma=0.8; markup=1.20; inflation = @(x) eta_p*(markup*x-1); y0=[convert([omega0,lambda0]),b0]; [tK,yK] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); plot(tK,yK(:,2)) title('\eta_p=3 and \gamma=0.8') xlabel('t') ylabel('\lambda') subplot(2,2,3) eta_p=1; gamma=0.96; markup=1.20; inflation = @(x) eta_p*(markup*x-1); y0=[convert([omega0,lambda0]),b0]; [tK,yK] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); plot(tK,yK(:,2)) title('\eta_p=1 and \gamma=0.96') xlabel('t') ylabel('\lambda') subplot(2,2,4) eta_p=4; gamma=0.96; markup=1.20; inflation = @(x) eta_p*(markup*x-1); y0=[convert([omega0,lambda0]),b0]; [tK,yK] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); plot(tK,yK(:,2)) title('\eta_p=4 and \gamma=0.96') xlabel('t') ylabel('\lambda') % Figure 2 figure(2) omega0=0.9; lambda0=0.9; b0=0.3; T=60; y0=[convert([omega0,lambda0]),b0]; eta_p=3; % NOTE: with eta_p=4 as in the paper, all omegas collapse to zero! gamma=0.8; markup=1.18; inflation = @(x) eta_p*(markup*x-1); [tK1,yK1] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK1(:,1),yK1(:,2)]); yK1(:,1)=sol(:,1); yK1(:,2)=sol(:,2); markup=1.19; inflation = @(x) eta_p*(markup*x-1); [tK2,yK2] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK2(:,1),yK2(:,2)]); yK2(:,1)=sol(:,1); yK2(:,2)=sol(:,2); markup=1.20; inflation = @(x) eta_p*(markup*x-1); [tK3,yK3] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK3(:,1),yK3(:,2)]); yK3(:,1)=sol(:,1); yK3(:,2)=sol(:,2); plot(tK1,yK1(:,1),'--g') hold on plot(tK2,yK2(:,1),'-.r') plot(tK3,yK3(:,1),'-b') legend('\xi=1.18','\xi=1.19','\xi=1.20') xlabel('t') ylabel('\omega') % Figure 3 figure(3) omega0=0.85; lambda0=0.9; b0=0.2; T=100; y0=[convert([omega0,lambda0]),b0]; eta_p=4; gamma=0.8; markup=1.19; % NOTE: with markup=1.20 as in the paper, the system converges to the interior equilibrium inflation = @(x) eta_p*(markup*x-1); [tK,yK] = ode15s(@(t,y) keen_inflation(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); yyaxis left plot(tK,yK(:,1),'-',tK,yK(:,2),'--') ylabel('\omega,\lambda') yyaxis right plot(tK,log(yK(:,3)),'-.g') ylabel('log(b)') legend('\omega','\lambda','b')

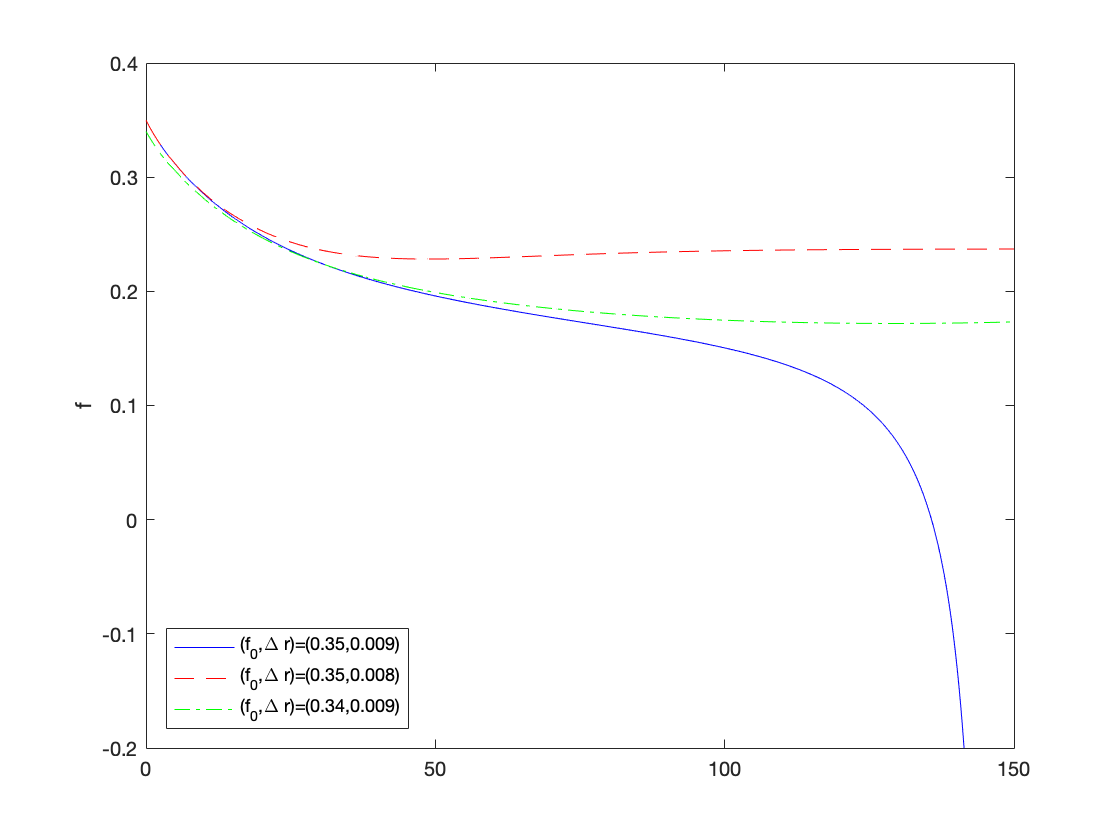

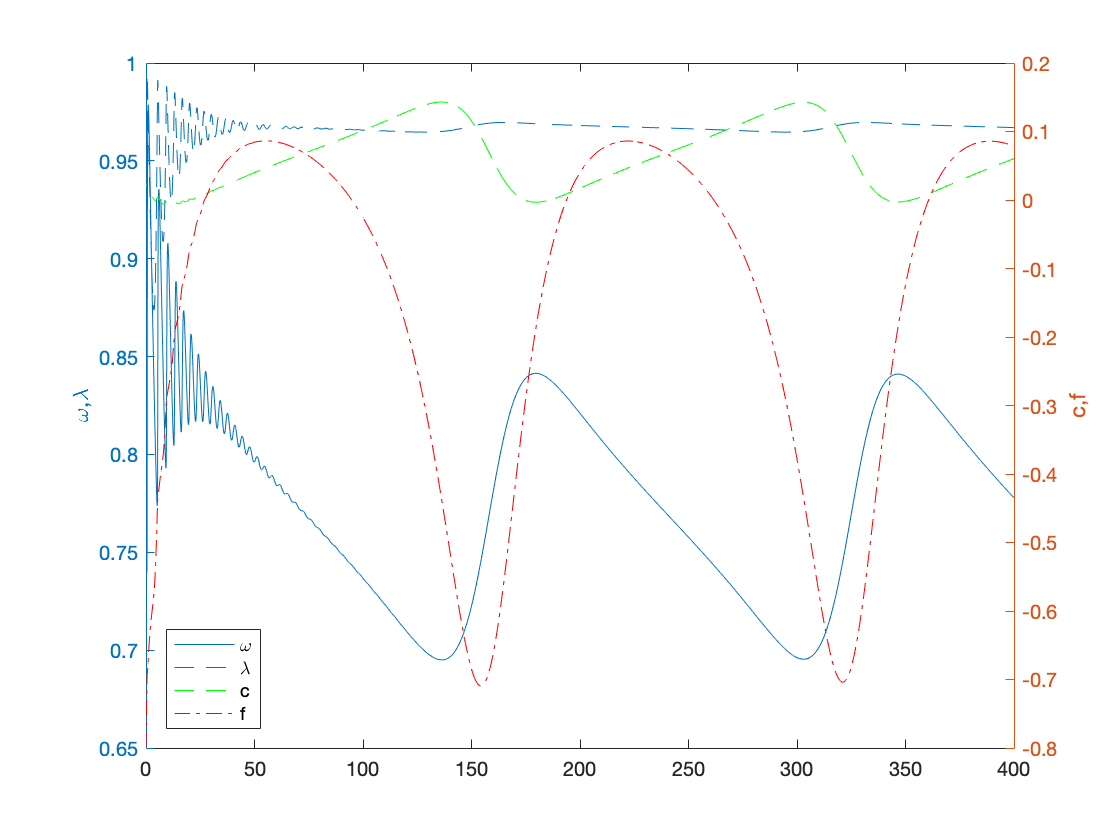

Section 5.2.2 - Keen Model with Inflation and Speculation (Dynamics)

% Figure 4 figure(4) omega0=0.9; lambda0=0.9; c0=0.05; T=150; eta_p=1; gamma=0.8; markup=1.3; inflation = @(x) eta_p*(markup*x-1); f0=0.35; rf=0.02; % NOTE: it is unclear what the choice of rL and rf is at this point in the paper rL=rf+0.009; % but the difference should be \Delta r = 0.009 instead of 0.09 y0=[convert([omega0,lambda0]),c0,f0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); plot(tK,yK(:,4),'b') ylabel('f') ylim([-0.2,0.4]) hold on f0=0.35; rf=0.02; rL=rf+0.008; y0=[convert([omega0,lambda0]),c0,f0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); plot(tK,yK(:,4),'--r') ylabel('f') hold on f0=0.34; rf=0.02; rL=rf+0.009; y0=[convert([omega0,lambda0]),c0,f0]; [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); plot(tK,yK(:,4),'-.g') ylabel('f') legend('(f_0,\Delta r)=(0.35,0.009)','(f_0,\Delta r)=(0.35,0.008)','(f_0,\Delta r)=(0.34,0.009)','Location','SouthWest') % Figure 5 figure(5) omega0=0.75; lambda0=0.9; c0=0.02; f0=-0.8; T=400; y0=[convert([omega0,lambda0]),c0,f0]; rL=0.03; rf=0.02; eta_p=0.4; gamma=0.8; markup=1.21; inflation = @(x) eta_p*(markup*x-1); [tK,yK] = ode15s(@(t,y) main(y), [0 T], y0, options); sol = retrieve([yK(:,1),yK(:,2)]); yK(:,1)=sol(:,1); yK(:,2)=sol(:,2); yyaxis left ylim([0.65,1]) plot(tK,yK(:,1),'-',tK,yK(:,2),'--') ylabel('\omega,\lambda') yyaxis right ylim([-0.8,0.5]) plot(tK,yK(:,3),'--g',tK,yK(:,4),'-.r') ylabel('c,f') legend('\omega','\lambda','c','f','Location','SouthWest') function new = convert(old) % This function converts % [omega, lambda] % to % [log_omega, tan_lambda] n = size(old,2); %number of variables new = zeros(size(old)); new(:,1) = log(old(:,1)); new(:,2) = tan((old(:,2)-0.5)*pi); end function old = retrieve(new) % This function retrieves [omega, lambda] % from % [log_omega, tan_lambda] n = size(new,2); %number of variables old = zeros(size(new)); old(:,1) = exp(new(:,1)); old(:,2) = atan(new(:,2))/pi+0.5; end function f = keen_inflation(y) % solves the Keen model with inflation f = zeros(3,1); log_omega = y(1); tan_lambda = y(2); b = y(3); lambda = atan(tan_lambda)/pi+0.5; omega = exp(log_omega); profit = 1-omega-r*b; growth = investment(profit)/nu-delta; % real growth rate % Equation (57) f(1) = phillips(lambda)-(1-gamma)*inflation(omega)-alpha; %d(log_omega)/dt f(2) = (1+tan_lambda^2)*pi*lambda*(growth-alpha-beta); %d(tan_lambda)/dt f(3) = investment(profit)-profit-(growth+inflation(omega))*b; %db/dt end function f = main(y) % solves the main dynamical system f = zeros(4,1); log_omega = y(1); tan_lambda = y(2); c = y(3); F= y(4); lambda = atan(tan_lambda)/pi+0.5; omega = exp(log_omega); profit = 1-omega-c; growth = investment(profit)/nu-delta; % real growth rate % Equation (57) f(1) = phillips(lambda)-(1-gamma)*inflation(omega)-alpha; %d(log_omega)/dt f(2) = (1+tan_lambda^2)*pi*lambda*(growth-alpha-beta); %d(tan_lambda)/dt f(3) = rL*investment(profit)-rf*profit-(growth+inflation(omega))*c+(rL-rf)*F; %dc/dt f(4) = speculation(growth+inflation(omega))-(growth+inflation(omega))*F; %dF/dt end

end