Contents

function out = keen_2000()

close all

clc

warning on

Parameters attribution and function definitions

par_alpha = 0.025;

par_beta = 0.02;

par_gamma = 0.01;

par_nu = 3;

par_r = 0.03;

par_A = -57.911;

par_B = 56.162;

par_C = -0.00956;

fun_Phi = @(x) exp(par_A+par_B.*x)+par_C;

fun_Phi_inv = @(y) (log(y-par_C)-par_A)./par_B;

par_A_mod = 0.0000641;

par_B_mod = 1;

par_C_mod = 0.0400641

fun_Phi_mod = @(x) par_A_mod./(par_B_mod-x).^2- par_C_mod;

fun_Phi_mod_inv = @(y) par_B_mod - sqrt(par_A_mod./(y+par_C_mod));

par_D = -5 ;

par_E = 20;

par_F = -0.0065;

fun_kappa = @(x) min(1,exp(par_D+par_E.*x)+par_F);

fun_kappa_inv = @(y) (log(y-par_F)-par_D)./par_E;

par_G = 13.5;

par_H = -18.5;

par_I = -0.018;

fun_Gamma = @(x) exp(par_G+par_H*x)+par_I;

par_J = -4.465;

par_K = 8.368;

par_L = -0.027;

fun_Theta = @(x) exp(par_J+par_K*x)+par_L;

TOL = 1E-7;

options = odeset('RelTol', TOL);

txt_format = '%3.3g';

par_C_mod =

0.0401

Perturbation analysis, page 93

lambda_eq = fun_Phi_inv(par_alpha)

pi_eq = fun_kappa_inv(par_nu*(par_alpha+par_beta+par_gamma))

d_eq = (par_nu*(par_alpha+par_beta+par_gamma)-pi_eq)/(par_alpha+par_beta)

omega_eq = 1-pi_eq-par_r*d_eq

omega0 = 0.81;

lambda0 = 0.94;

d0 = 0.04;

y0 = [convert([omega0, lambda0]),d0];

T = 80;

par1 = [par_nu,par_alpha,par_beta,par_gamma,par_r,par_A,par_B,par_C,par_D,par_E,par_F];

[tK,yK] = ode15s(@(t,y) keen(y,par1), [0 T], y0, options);

yKnew = retrieve([yK(:,1),yK(:,2)]);

yK(:,1) = yKnew(:,1);

yK(:,2) = yKnew(:,2);

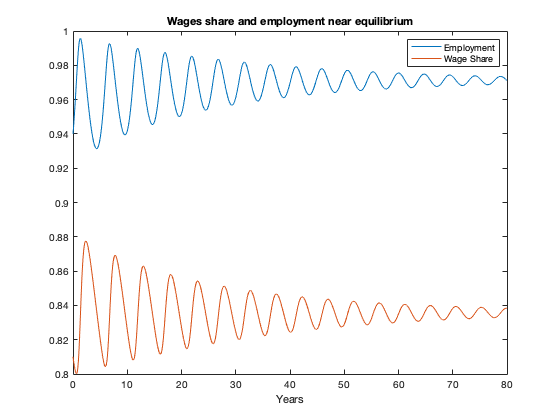

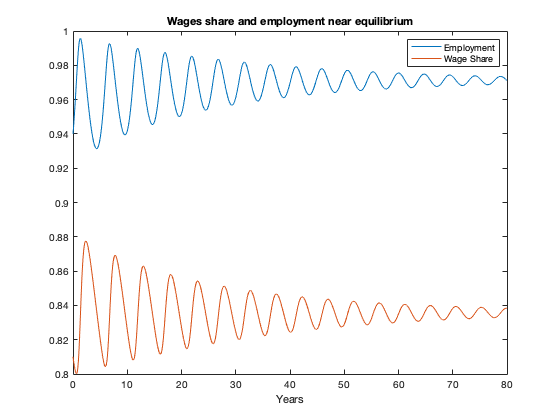

figure(1)

plot(tK, yK(:,2),tK,yK(:,1))

xlabel('Years')

legend('Employment','Wage Share')

title(['Wages share and employment near equilibrium'])

figure(2)

plot(tK, yK(:,3))

xlabel('Years')

ylabel('Debt to output ratio')

title(['Debt-to-output ratio near equilibrium'])

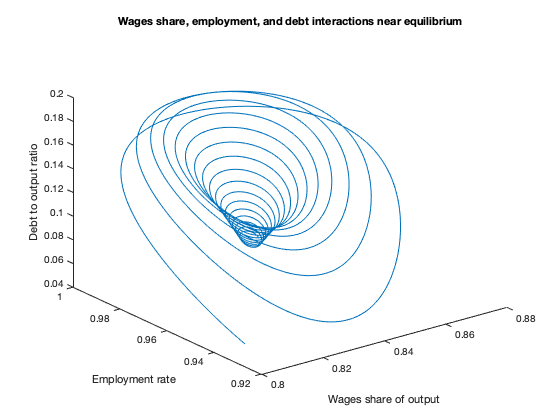

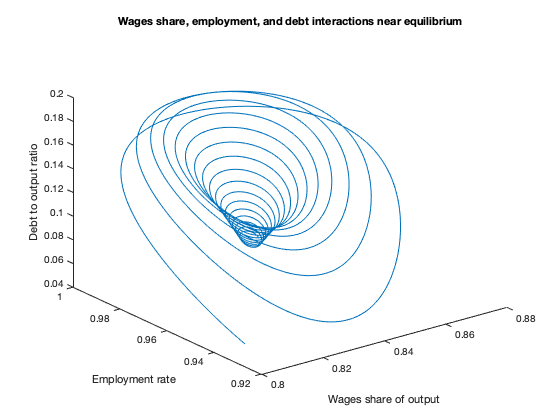

figure(3)

plot3(yK(:,1),yK(:,2),yK(:,3))

xlabel('Wages share of output')

ylabel('Employment rate')

zlabel('Debt to output ratio')

title(['Wages share, employment, and debt interactions near equilibrium'])

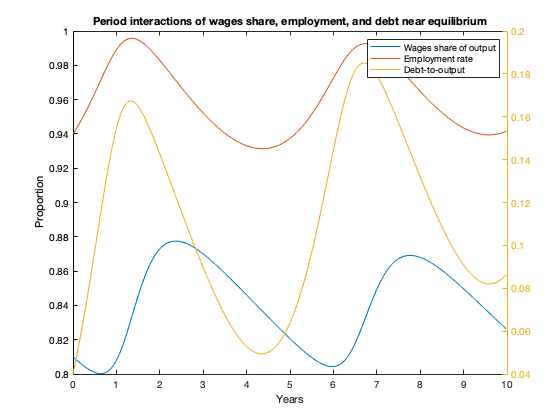

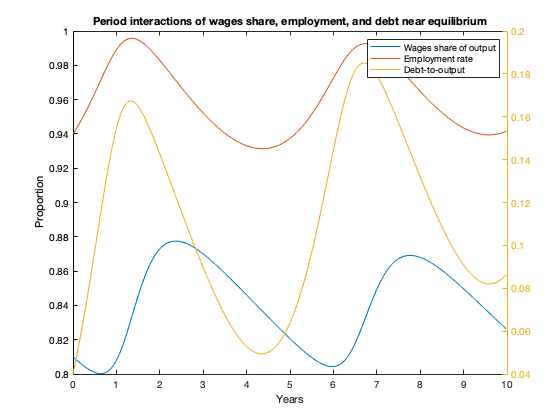

figure(4)

N=max(find(tK<=10));

plot(tK(1:N), yK(1:N,1),tK(1:N),yK(1:N,2))

xlabel('Years')

ylabel('Proportion')

yyaxis('right')

ylabel('Debt-to-output ratio')

plot(tK(1:N), yK(1:N,3))

legend('Wages share of output','Employment rate','Debt-to-output')

title(['Period interactions of wages share, employment, and debt near equilibrium'])

lambda_eq_mod = fun_Phi_mod_inv(par_alpha);

omega0 = omega_eq-0.11;

lambda0 = lambda_eq_mod-0.05;

d0 = d_eq;

y0 = [convert([omega0, lambda0]),d0];

T = 100;

par2_mod = [par_nu,par_alpha,par_beta,par_gamma,par_r,par_A_mod,par_B_mod,par_C_mod,par_D,par_E,par_F];

[tK,yK] = ode15s(@(t,y) keen_mod(y,par2_mod), [0 T], y0, options);

yKnew = retrieve([yK(:,1),yK(:,2)]);

yK(:,1) = yKnew(:,1);

yK(:,2) = yKnew(:,2);

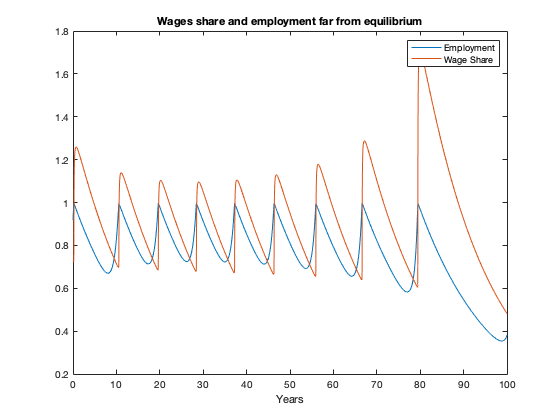

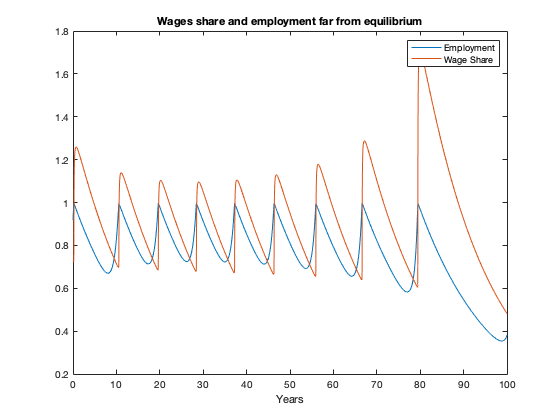

figure(5)

plot(tK, yK(:,2),tK,yK(:,1))

xlabel('Years')

legend('Employment','Wage Share')

title(['Wages share and employment far from equilibrium'])

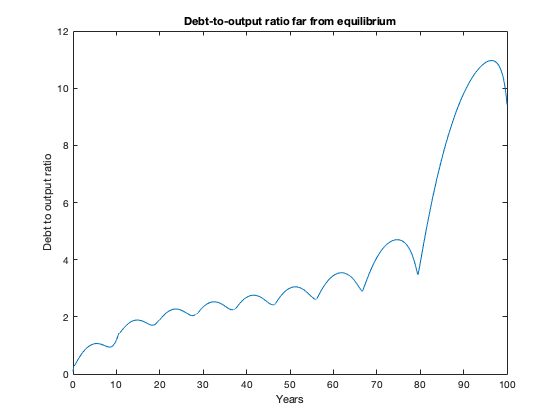

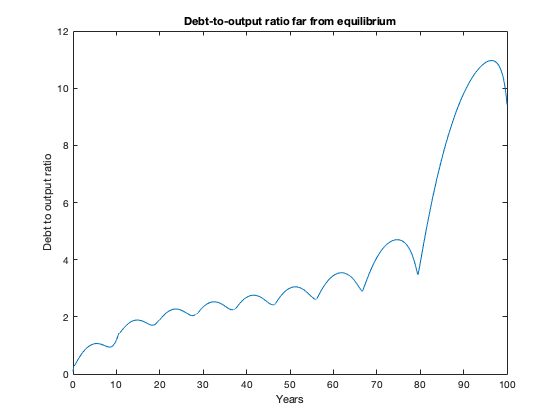

figure(6)

plot(tK, yK(:,3))

xlabel('Years')

ylabel('Debt to output ratio')

title(['Debt-to-output ratio far from equilibrium'])

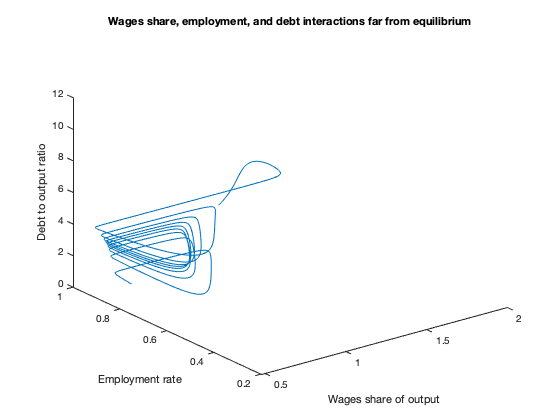

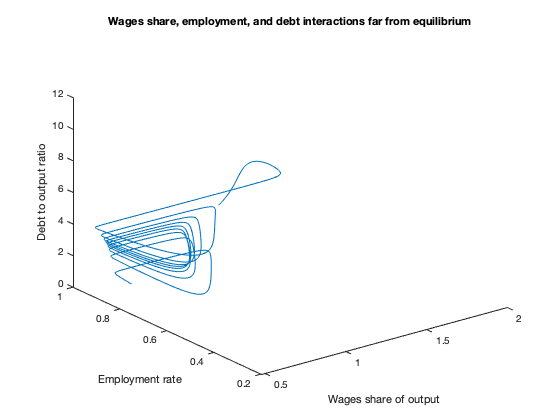

figure(7)

plot3(yK(:,1),yK(:,2),yK(:,3))

xlabel('Wages share of output')

ylabel('Employment rate')

zlabel('Debt to output ratio')

title(['Wages share, employment, and debt interactions far from equilibrium'])

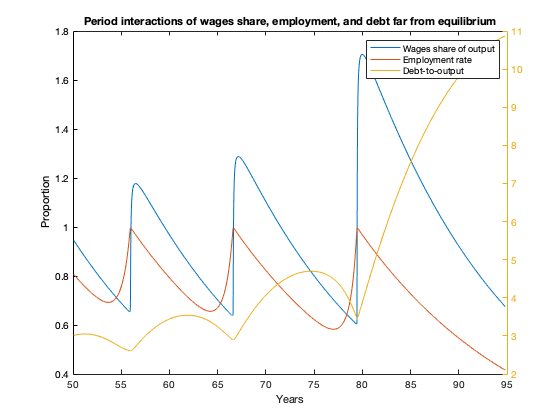

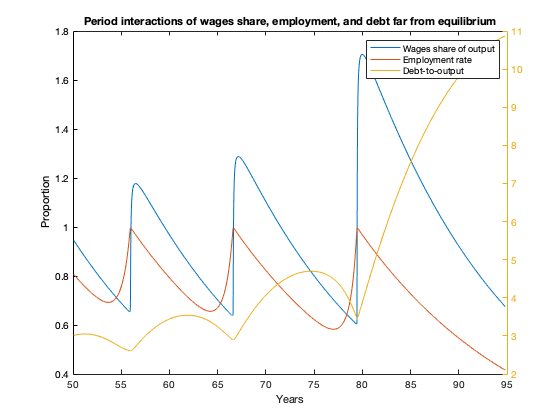

figure(8)

N_min=min(find(tK>50));

N_max=max(find(tK<=95));

plot(tK(N_min:N_max), yK(N_min:N_max,1),tK(N_min:N_max),yK(N_min:N_max,2))

xlabel('Years')

ylabel('Proportion')

yyaxis('right')

ylabel('Debt-to-output ratio')

plot(tK(N_min:N_max), yK(N_min:N_max,3))

legend('Wages share of output','Employment rate','Debt-to-output')

title(['Period interactions of wages share, employment, and debt far from equilibrium'])

lambda_eq =

0.9712

pi_eq =

0.1618

d_eq =

0.0702

omega_eq =

0.8361

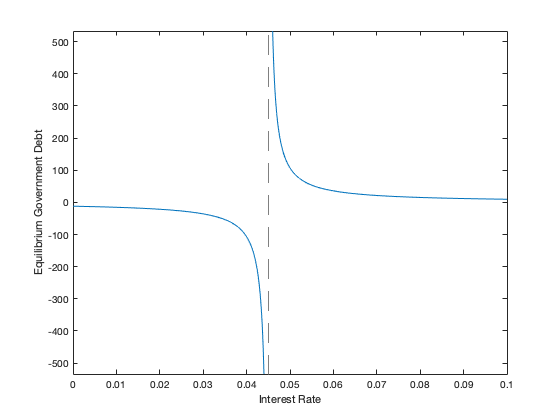

Adding a government sector, page 100

par3_mod = [par_nu,par_alpha,par_beta,par_gamma,par_r,par_A_mod,par_B_mod,par_C_mod,par_D,par_E,par_F...

par_G,par_H,par_I,par_J,par_K,par_L];

lambda_eq = fun_Phi_inv(par_alpha)

pi_eq = fun_kappa_inv(par_nu*(par_alpha+par_beta+par_gamma))

g_eq = fun_Gamma(lambda_eq)/(par_alpha+par_beta)

t_eq = fun_Theta(pi_eq)/(par_alpha+par_beta)

d_eq = (par_nu*(par_alpha+par_beta+par_gamma)-pi_eq)/(par_alpha+par_beta)

omega_eq = 1-pi_eq-par_r*d_eq-t_eq+g_eq

d_g_eq=(t_eq-g_eq)/(par_r-par_alpha-par_beta)

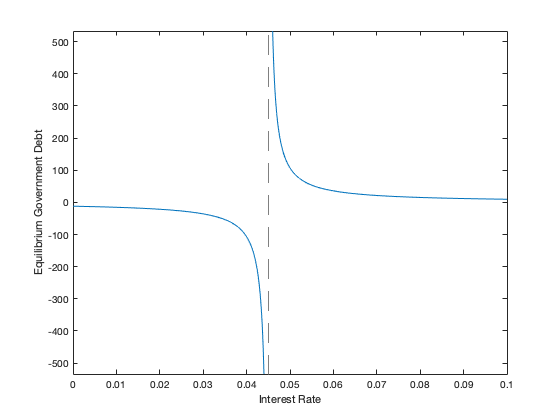

figure(9)

z=[];

syms d_g(z)

d_g(z) = (t_eq-g_eq)/(z-par_alpha-par_beta);

fplot(d_g,[0,0.1]);

xlabel('Interest Rate')

ylabel('Equilibrium Government Debt')

omega0 = 0.31;

lambda0 = 0.98;

dk0 = 0.08;

dg0 = -36;

g0 = -0.13;

t0 = 0.4;

y0 = [convert([omega0, lambda0]),dk0,dg0,g0,t0];

T = 200;

[tK,yK] = ode15s(@(t,y) keen_government(y,par3_mod), [0 T], y0, options);

yKnew = retrieve([yK(:,1),yK(:,2)]);

yK(:,1) = yKnew(:,1);

yK(:,2) = yKnew(:,2);

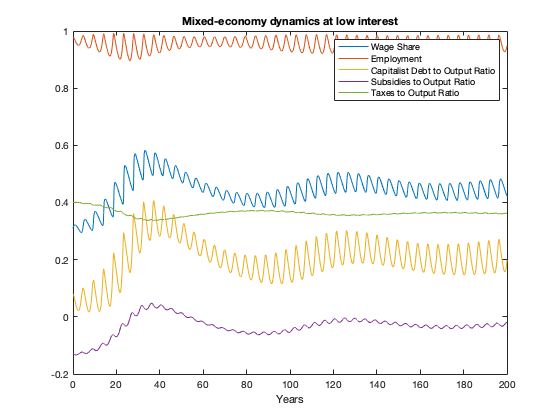

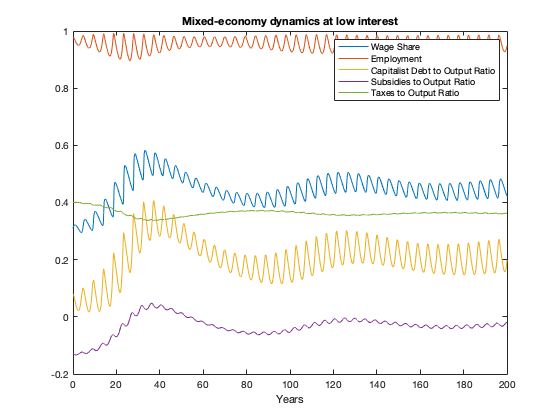

figure(10)

plot(tK, yK(:,1),tK,yK(:,2),tK,yK(:,3),tK,yK(:,5),tK,yK(:,6))

xlabel('Years')

legend('Wage Share','Employment','Capitalist Debt to Output Ratio','Subsidies to Output Ratio','Taxes to Output Ratio')

title(['Mixed-economy dynamics at low interest'])

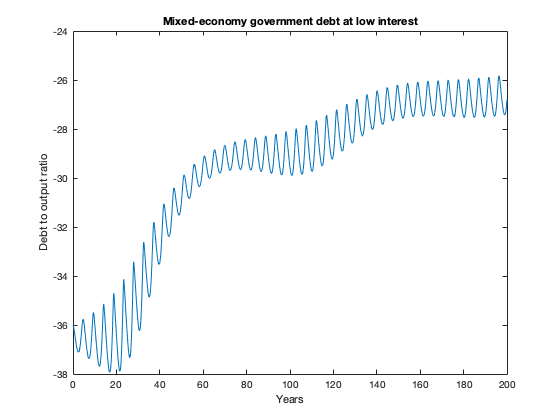

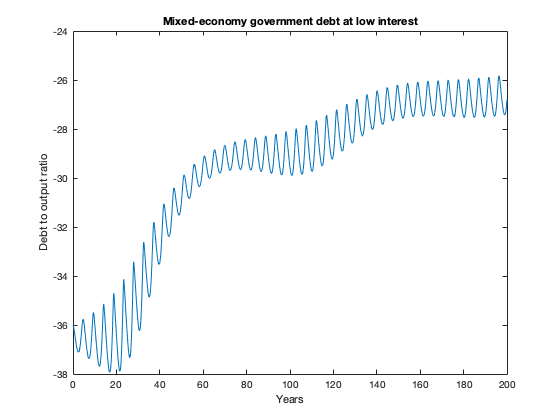

figure(11)

plot(tK, yK(:,4))

xlabel('Years')

ylabel('Debt to output ratio')

title(['Mixed-economy government debt at low interest'])

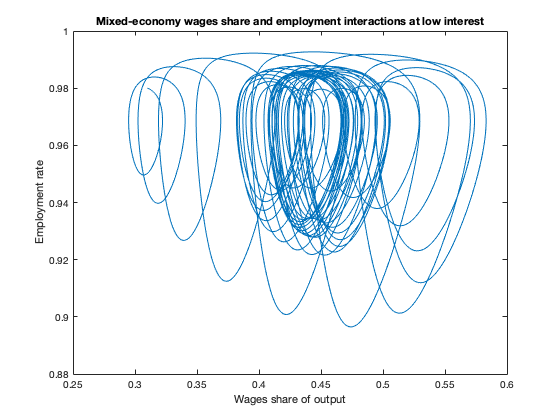

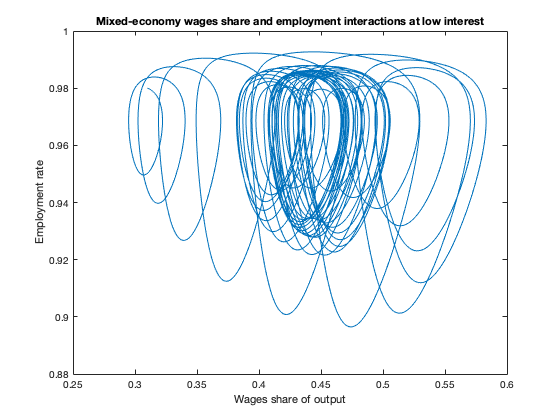

figure(12)

plot(yK(:,1),yK(:,2))

xlabel('Wages share of output')

ylabel('Employment rate')

title(['Mixed-economy wages share and employment interactions at low interest'])

par_r = 0.05;

par4_mod = [par_nu,par_alpha,par_beta,par_gamma,par_r,par_A_mod,par_B_mod,par_C_mod,par_D,par_E,par_F...

par_G,par_H,par_I,par_J,par_K,par_L];

omega0 = 0.31;

lambda0 = 0.98;

dk0 = 0.08;

dg0 = 110;

g0 = -0.13;

t0 = 0.4;

y0 = [convert([omega0, lambda0]),dk0,dg0,g0,t0];

T = 200;

[tK,yK] = ode15s(@(t,y) keen_government(y,par4_mod), [0 T], y0, options);

yKnew = retrieve([yK(:,1),yK(:,2)]);

yK(:,1) = yKnew(:,1);

yK(:,2) = yKnew(:,2);

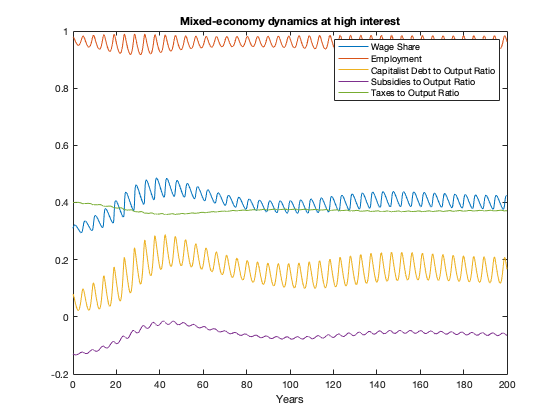

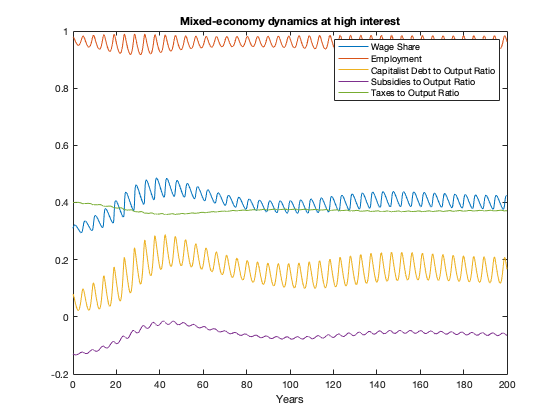

figure(13)

plot(tK, yK(:,1),tK,yK(:,2),tK,yK(:,3),tK,yK(:,5),tK,yK(:,6))

xlabel('Years')

legend('Wage Share','Employment','Capitalist Debt to Output Ratio','Subsidies to Output Ratio','Taxes to Output Ratio')

title(['Mixed-economy dynamics at high interest'])

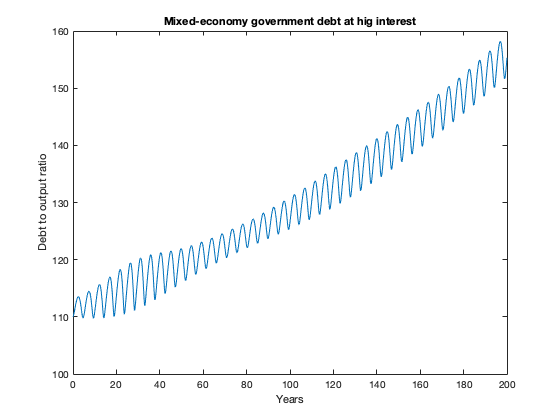

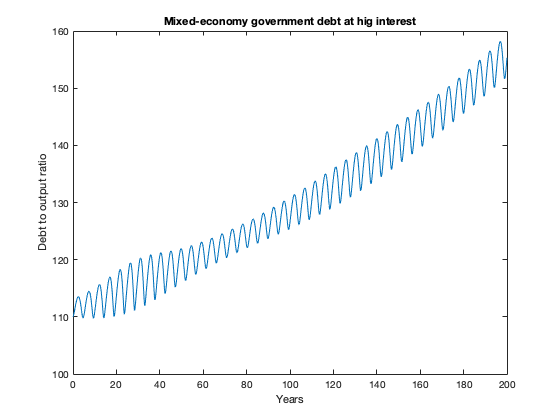

figure(14)

plot(tK, yK(:,4))

xlabel('Years')

ylabel('Debt to output ratio')

title(['Mixed-economy government debt at hig interest'])

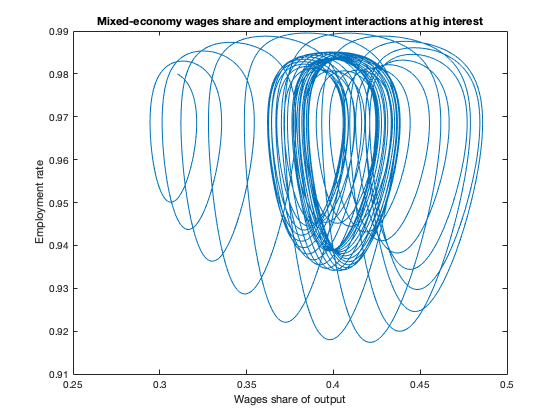

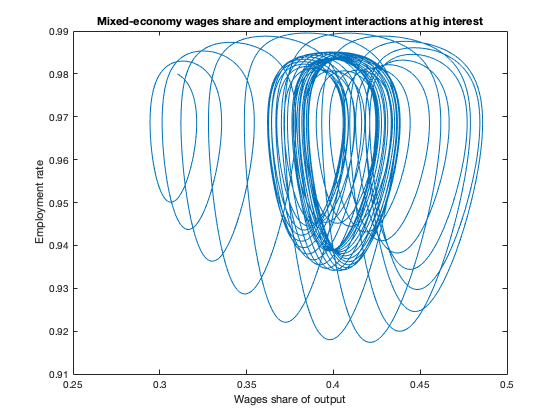

figure(15)

plot(yK(:,1),yK(:,2))

xlabel('Wages share of output')

ylabel('Employment rate')

title(['Mixed-economy wages share and employment interactions at hig interest'])

lambda_eq =

0.9712

pi_eq =

0.1618

g_eq =

-0.1450

t_eq =

0.3904

d_eq =

0.0702

omega_eq =

0.3006

d_g_eq =

-35.6965

Auxiliary functions

function new = convert(old,r)

n = size(old,2);

new = zeros(size(old));

new(:,1) = log(old(:,1));

new(:,2) = tan((old(:,2)-0.5)*pi);

if n>2

new(:,3) = 1-old(:,1)-r*old(:,3);

if n==4

new(:,4) = log(old(:,4));

end

end

end

function old = retrieve(new,r)

n = size(new,2);

old = zeros(size(new));

old(:,1) = exp(new(:,1));

old(:,2) = atan(new(:,2))/pi+0.5;

if n>2

old(:,3) = (1-old(:,1)-new(:,3))/r;

if n==4

old(:,4) = exp(new(:,4));

end

end

end

function f = keen(y,par)

f = zeros(3,1);

log_omega = y(1);

tan_lambda = y(2);

d = y(3);

lambda = atan(tan_lambda)/pi+0.5;

omega = exp(log_omega);

nu = par(1);

alpha = par(2);

beta = par(3);

gamma = par(4);

r = par(5);

A = par(6);

B = par(7);

C = par(8);

D = par(9);

E = par(10);

F = par(11);

pi_n = 1-omega-r*d;

phillips = exp(A+B*lambda)+C;

kappa = exp(D+E*pi_n)+F;

g_Y = kappa/nu-gamma;

f(1) = phillips-alpha;

f(2) = (1+tan_lambda^2)*pi*lambda*(g_Y-alpha-beta);

f(3) = d*(r-(kappa/nu-gamma))+kappa-(1-omega);

end

function f = keen_mod(y,par)

f = zeros(3,1);

log_omega = y(1);

tan_lambda = y(2);

d = y(3);

lambda = atan(tan_lambda)/pi+0.5;

omega = exp(log_omega);

nu = par(1);

alpha = par(2);

beta = par(3);

gamma = par(4);

r = par(5);

A = par(6);

B = par(7);

C = par(8);

D = par(9);

E = par(10);

F = par(11);

pi_n = 1-omega-r*d;

phillips = A./(B-lambda)^2- C;

kappa = exp(D+E*pi_n)+F;

g_Y = kappa/nu-gamma;

f(1) = phillips-alpha;

f(2) = (1+tan_lambda^2)*pi*lambda*(g_Y-alpha-beta);

f(3) = d*(r-(kappa/nu-gamma))+kappa-(1-omega);

end

function f = keen_government(y,par)

f = zeros(6,1);

log_omega = y(1);

tan_lambda = y(2);

dk = y(3);

dg = y(4);

g = y(5);

t = y(6);

lambda = atan(tan_lambda)/pi+0.5;

omega = exp(log_omega);

nu = par(1);

alpha = par(2);

beta = par(3);

gamma = par(4);

r = par(5);

A = par(6);

B = par(7);

C = par(8);

D = par(9);

E = par(10);

F = par(11);

G = par(12);

H = par(13);

I = par(14);

J = par(15);

K = par(16);

L = par(17);

pi_n = 1-omega-r.*dk+g-t;

phillips = A./(B-lambda)^2- C;

kappa = exp(D+E*pi_n)+F;

Gamma = exp(G+H*lambda)+I;

Theta = exp(J+K*pi_n)+L;

g_Y = kappa/nu-gamma;

f(1) = phillips-alpha;

f(2) = (1+tan_lambda^2)*pi*lambda*(g_Y-alpha-beta);

f(3) = kappa-(1-omega)+t-g+dk*(r-kappa/nu+gamma);

f(4) = dg*(r-kappa/nu+gamma)+g-t;

f(5) = Gamma - g*(kappa/nu-gamma);

f(6) = Theta - t*(kappa/nu-gamma);

end

end